About Us

The future of banking

We believe in the Future of Banking, based on reliability and trust combined with new technologies, instruments and a deep know how of IT knowledge in the domain of financial investments.

This combination of senior management with long term experience and an innovative team allows us to react very fast on market behavior, technology trends but to be patient on a long term view.

The banking business will look very different from today in the near future. Faced with changing consumer expectations, emerging technologies, and new business models, banks will need to start putting strategies in place now to help them prepare for the future. Across industries, technology transformation is a necessity for businesses looking to ensure longevity and remain competitive. Another reason that fewer and fewer clients entrust their money to banks is the fear that they may cease to exist during the next financial crisis, and these clients are looking in the direction of payment companies. One of the biggest advantages of fintech companies is that they efficiently deal with clients’ needs and respect their time, because they understand how valuable it is.

It starts and ends with focusing on what customers want: the customer is at the center of what we do.

Our Vision

The banking industry has come a long way since the first bank was established in the 15th century. Today, banking has evolved into a complex and diverse industry, with a wide range of services and products that cater to the needs of businesses and individuals. However, the banking industry is currently undergoing a transformation that is set to shape its future for years to come.

One of the biggest drivers of change in the banking industry is technology. Technology has revolutionized the way we bank, making it faster, easier and more convenient than ever before. The rise of mobile and online banking has allowed customers to carry out transactions and access their accounts from anywhere in the world. The development of biometric authentication methods, such as facial recognition and fingerprint scanning, has also made banking more secure.

Another significant change in the banking industry is the shift towards digital currencies. While traditional currencies have been around for centuries, digital currencies such as Bitcoin, Ethereum, and others have become more popular in recent years. The blockchain technology that underpins digital currencies has the potential to make transactions faster, cheaper, and more secure. This has led to an increase in the number of people using digital currencies for their transactions.

The emergence of fintech startups is also changing the banking industry. Fintech companies are using technology to create innovative solutions that are disrupting the traditional banking model. These startups are challenging the established banks with faster, cheaper, and more user-friendly services, often without the need for physical branches. Fintech startups have been successful in attracting younger, tech-savvy customers who are looking for banking solutions that fit their lifestyle.As technology continues to shape the banking industry, the role of the traditional bank is also changing. Banks are increasingly becoming digital-first, with a focus on offering services through online and mobile channels.

They are also investing in technologies such as artificial intelligence and machine learning to improve their customer experience and make banking more efficient.

Looking to the future, it is clear that the banking industry will continue to evolve. The emergence of new technologies such as blockchain and digital currencies will continue to shape the way we bank. The rise of fintech companies will also push traditional banks to innovate and adapt to stay competitive. It is likely that we will see more collaboration between banks and fintech startups in the future.

In conclusion, the future of banking is set to be exciting and full of opportunities.

With our banking and Technology knowledge, we will help Fintechs driving force in shaping the banking industry, making it faster, more convenient, and more secure. The future of banking is digital, and the banks that embrace this change will be the ones that thrive in the years to come.

Let us help you to go this path to success.

Cooperate with us to shape your banking process

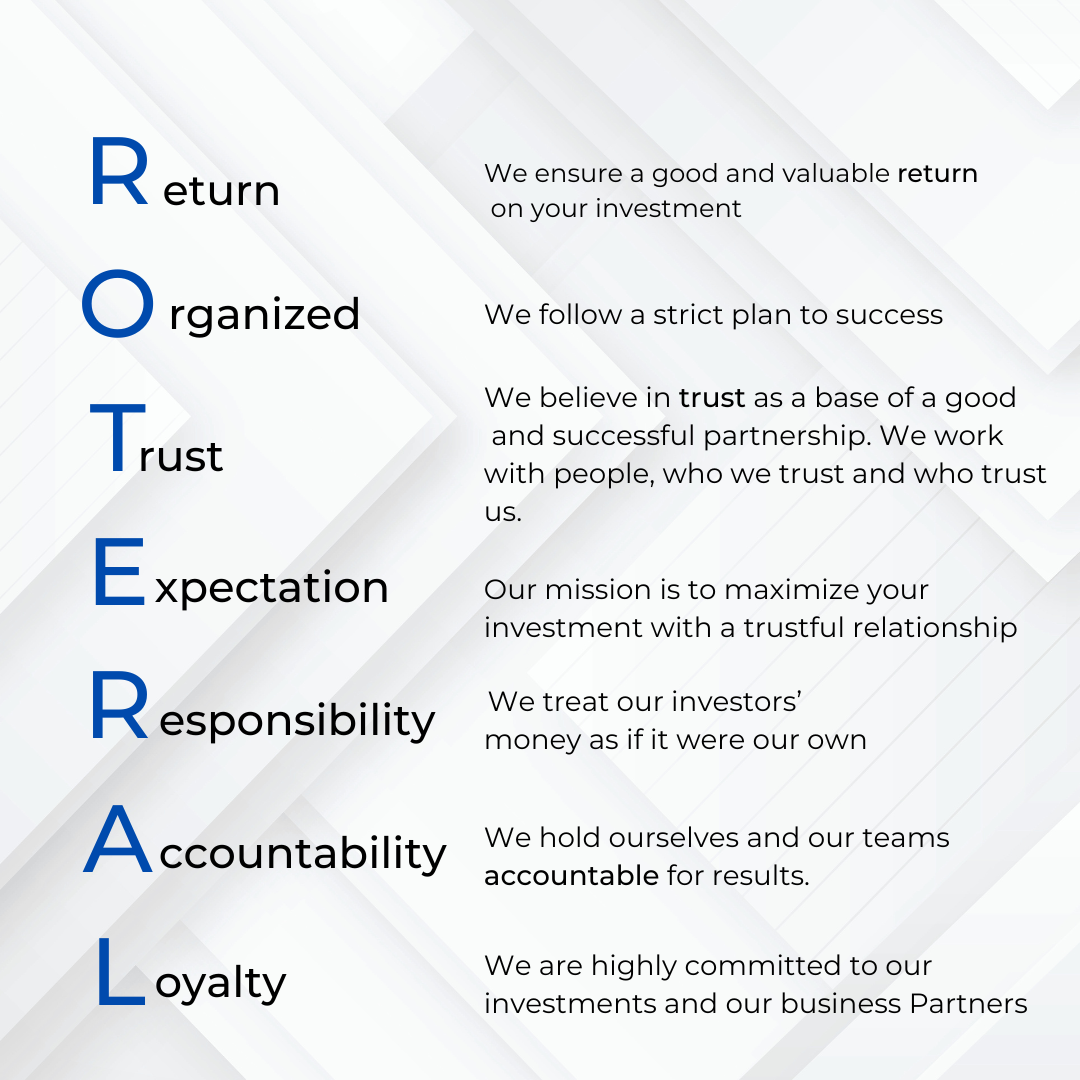

Our Mission & Values

Providing firms and especially startups more than just financial support. We will help to grow your business, offer guidance, connect you with potential customers, and provide support throughout your journey to successful together.

We will be the preferred provider of targeted financial service in our communities based on strong customer relationships. We will strengthen these relationships by providing the right solutions that combine our technology, experience, and financial strength.

Through our common journey, we provide:

- Funding

- Expertise

- Networking

- Support

- Growth Opportunities